is property tax included in mortgage loan

Property taxes can be included in your mortgage payment at your option if your loan-to-value LTV ratio is less than 80. The most likely answer is yes but you should.

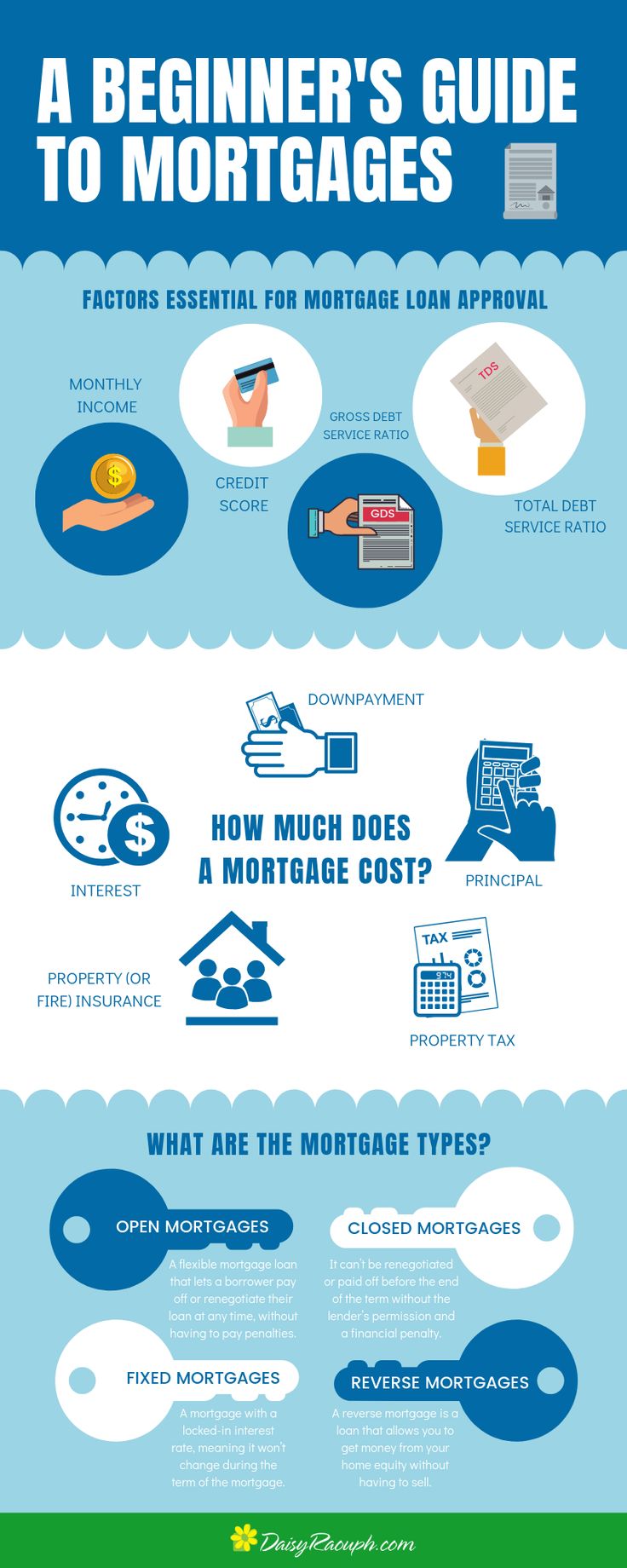

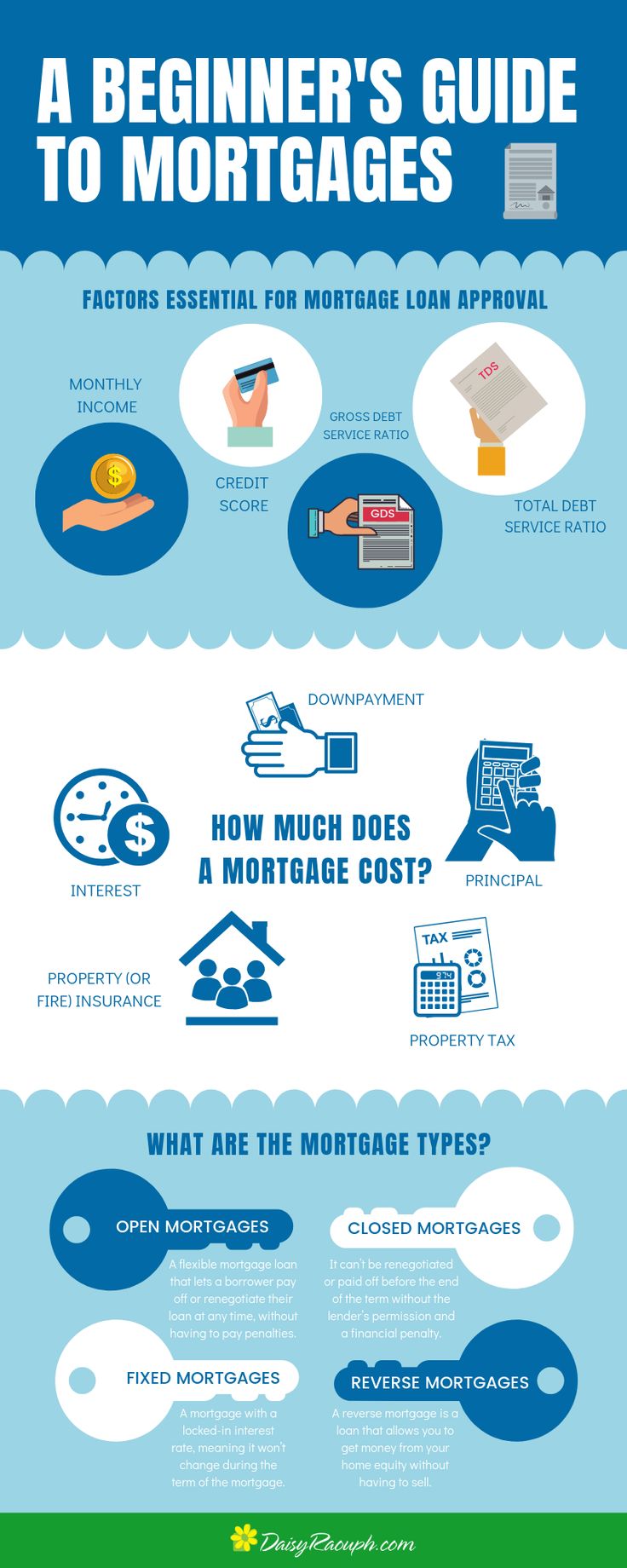

A Beginner S Guide To Mortgages Beginners Guide Mortgage Mortgage Loans

Home Buyers especially first time.

. Get The Service You Deserve With The Mortgage Lender You Trust. Lock In Lower Monthly Payments When You Refinance Your Home Mortgage. The state of Texas is experiencing a property tax.

If your home was assessed at 400000 and the property tax rate is 062 you would pay 2480 in property taxes 400000 x 00062 2480. Your property taxes are usually included in your monthly mortgage payment though they can be paid directly At closing the buyer and seller pay for any outstanding. There are two primary reasons for this.

Loans Up To 4 Million Loan-To-Values Up To 75 And Flexible Terms From 2-7 Years. If you close on August 10th you will pay 21. If you qualify for a 50000.

FHA VA Conventional HARP And Jumbo Mortgages Available. 1500 Estimated monthly mortgage payments 1150 for loan principal and interest plus 50 for homeowners insurance and 300 for property taxes 300 Monthly car. For example if your lender estimates youll pay 2500 in property taxes in a year and you make your mortgage payments monthly your lender will collect an extra 20833 2500 12.

A few significant mortgage rates moved up Friday. Non-QM loans can be useful if you dont qualify for another type of mortgage but theyre often expensive and can be risky. Ad Val-Chris Is A Private Money Lender Specializing In Secure Non-Qualified Mortgage Loans.

Apply Now With Rocket Mortgage. Your property taxes are included in your monthly home loan payments. Although it may not be a top priority you may wonder if your property taxes are included in your monthly mortgage payments.

Are Property Taxes Included In A Mortgage Payment Most lenders require that taxes be included in your mortgage payment. Your monthly mortgage payments include the principal interest property tax mortgage insurance and homeowners insurance. Property taxes are included in mortgage payments for most homeowners.

The common term for this arrangement is. If you have 20 equity or less in your home or are a first-time homebuyer your lender will likely require that they collect property taxes on your behalf. 19 hours agoPros and cons of non-QM loans.

ASSESSED VALUE x PROPERTY TAX RATE PROPERTY TAX Lets say your home. Ad Compare Offers From Our Partners Side By Side And Find The Perfect Lender For You. The average interest rates for both 15-year fixed and 30.

The average effective property tax rate in the Lone Star State is 1699 which is higher than the national average of 107. In most cases if youâre a first-time homebuyer your lender is going to require that you pay your property taxes through your mortgage. Ad Compare Mortgage Options Calculate Payments.

The answer to that usually is yes. Ad See Todays Rate Get The Best Rate In A 90 Day Period. So if youre putting down 20 or more on a.

This is because not. If you get a home loan through a private lender then. 16 2022 600 am.

All you have to do is take your homes assessed value and multiply it by the tax rate. Ad See Todays Rate Get The Best Rate In A 90 Day Period. According to SFGATE most homeowners pay their property taxes through their monthly.

FHA VA Conventional HARP And Jumbo Mortgages Available. This BLOG On Property Taxes In Mortgage Qualification And How It Affects DTI Was UPDATED And PUBLISHED On February 25th 2020. Get Your Estimate Today.

The Trusted Lender of 300000 Veterans and Military Families.

9 Hidden Costs That Come With Buying A Home Buying First Home Buying Your First Home First Home Buyer

Should I Wait To Put Down A Bigger Down Payment Refinance Mortgage Mortgage Loan Originator Mortgage

The Time Is Drawing Near Property Taxes Are Due April 10th Propertytax Property Tax Mortgage Loans Money Finance Property Tax What Is Property Tax

Pin On Martin Alvarado Lending

Check Out These Common And Costly Mistakes To Make Sure Nothing Prevents You From Owning Your Dream Home Apply Now B Real Estate News Loan Account Home Buying

Pin On Real Estate Investing Rental Property

Hypotec Is Here To Help Take Advantage Of Our 10 Years Experience To Find You Low Refi Rates And A R Real Estate Infographic Real Estate Advice Mortgage Tips

Private Mortgage Contract Template Free Printable Documents Contract Template Corporate Credit Card Templates Printable Free

Mortgage Calculator With Escrow Excel Spreadsheet Mortgage Payment Calculator Mortgage Payment Mortgage

4 Financial Advantages Of Owning A Home Middleburg Real Estate Atoka Properties Financial Budgeting Money Budgeting

Terms To Know Before You Start Your Home Search Real Estate Terms Home Buying Process Real Esate

House Loan Concept Isolated On White Background Premium Image By Rawpixel Com Niwat Model Homes Investment Property For Sale Real Estate Courses

For Tax Day Real Estate Deductions Helped Tax Payers Save More Than 90 Billion In 2011 Business Planning Filing Taxes Tax Day

What You Need To Know About Property Taxes Property Tax Refinancing Mortgage Tax Deductions

3 Tips For Buying A Home Today Greater Memphis And Northwest Mississippi Real Estate Your New Home Key In 2022 Home Buying Mortgage Interest Rates Mortgage Payment

How Property Taxes Can Impact Your Mortgage Payment Property Tax Mortgage Payment Mortgage

Mortgage Loan Disclosure Statement Calbre 883 Mortgage Loans Mortgage Loan